At a time when the health of the U.S. economy and creating and maintaining U.S. manufacturing jobs are top of mind, the “Made in the USA” claim on products resonates among consumers. The claim communicates the entrepreneur’s efforts to create or preserve American jobs. While the value of an origin claim from the U.S. is clear, a product must first clear the legal hurdles to use the coveted “Made in the USA” label. This article addresses the standards for claiming a product as “Made in the USA” under Federal and California law.

Federal Law

The Federal Trade Commission (FTC) is the agency responsible for policing origin claims in the marketplace. FTC standards are therefore the primary determinant as to whether or not a claim of US origin has been properly made. The FTC’s regulations distinguish claims of US origin into two categories: unqualified claims and qualified claims, both of which are subject to different requirements.

Unqualified Claims

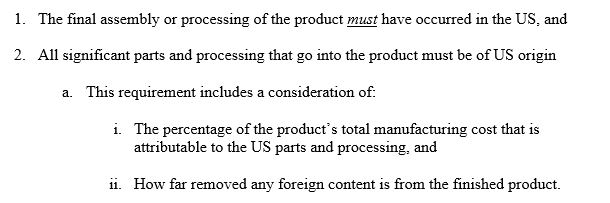

A product claiming its origin is the US without qualification, such as in the basic “Made in the USA” label, is considered an unqualified claim. Non-explicit, implied claims of US origin like a US flag or map may also be considered an unqualified claim of US origin. Because there is no qualification to the origin claim, consumers assume such a product is made entirely, or nearly entirely, within the United States. The FTC incorporates this consumer assumption into their test for unqualified claims. The agency requires an unqualified claim of US origin to be substantiated with evidence that the product is entirely or virtually entirely made within the US. The standard is somewhat vague, but there are two requirements that are considered in determining whether an unqualified claim is lawful:

The first requirement is a clear standard. The second requirement needs some explanation. With regard to factor (i), there is no set percentage threshold of a product’s total manufacturing cost that must be attributable to US parts and processing. Instead, determinations are made on a case-by-case basis and involve a consideration of foreign versus domestic costs, the nature of the product, and consumer’s expectations. With regard to factor (ii), the earlier in the production process that foreign content is included, the less significant that content is considered to be to consumers. For example, the origin of raw materials in electronics, such as rubber wire coating made from petroleum extracted in Africa, is likely not meaningfully proximal to the final assembled product and may therefore be of little to no importance to the unqualified claim. When evaluating an origin claim, each factor and relevant circumstance must be carefully taken into consideration to determine whether the product can be labeled “made in the USA” without qualification.

Qualified Claims

A product that does not meet the “all or virtually all” standard must qualify its claim of US origin. These claims are subject to less stringent requirements than those applied to unqualified claims. A qualified origin claim must disclose the extent, amount, or type of constituents in the product that were domestically made in a prominent and clear manner – e.g., “Sheets manufactured in the USA from Indian cotton”. An accurate description of US and foreign components comprising the product will generally allow for a qualified US origin claim to pass muster. The language used in the qualified origin claim must be sufficiently accurate to avoid a likelihood to deceive consumers. Products that are only partly assembled in the USA cannot include a general phrase that suggests that the entire product was “assembled in the USA”. The unqualified claim must be more specific. For example, if a computer is assembled in the US from components that were made and assembled overseas (e.g., a hard drive made and assembled in China), the qualified claim should be something like “final assembly in USA”.

While the requirements set forth by the FTC are reasonably comprehensible, they are not the only regulations that must be considered. State laws, while often mirroring the FTC rules, provide further requirements for US origin claims to be used within each state. This article addresses California as an example.

California Law

The purveyor of products in California with a claim to hail from the US must satisfy both California law and FTC regulations. In contrast to the FTC, California law takes a singular approach to regulating claims of US origin. The California standard makes no distinction between qualified and unqualified origin claims.

The governing California statute, Business & Professions Code section 17533.7, applies to products sold in California. The statute permits a product to use a US origin designation in California, if foreign content represents no more than 5% of the final wholesale value of the product (Bus. & Prof. 17533.7(b)). This requirement is wholly determinative of the validity of a US origin designation in California with one exception: foreign content can represent up to 10% of the final wholesale value of the product, if some of the parts or content of the product cannot be obtained within the United States. California’s test is more straightforward than that of the FTC, but both standards must be observed for any products sold in California. If a business sells goods in multiple states with a claim of US origin, it would potentially have to juggle several standards if the product was not 100% made in the US. Thus, purveyors of goods should be wary of the particular standards in the markets they serve.

© 2021 Sierra IP Law. The information provided herein is not intended to be legal advice, but merely conveys general information that may be beneficial to the legal professional community, and should not be viewed as a substitute for legal consultation in a particular case.

"Mark and William are stellar in the capabilities, work ethic, character, knowledge, responsiveness, and quality of work. Hubby and I are incredibly grateful for them as they've done a phenomenal job working tirelessly over a time span of at least five years on a series of patents for hubby. Grateful that Fresno has such amazing patent attorneys! They're second to none and they never disappoint. Thank you, Mark, William, and your entire team!!"

Linda Guzman

Sierra IP Law, PC - Patents, Trademarks & Copyrights

FRESNO

7030 N. Fruit Ave.

Suite 110

Fresno, CA 93711

(559) 436-3800 | phone

BAKERSFIELD

1925 G. Street

Bakersfield, CA 93301

(661) 200-7724 | phone

SAN LUIS OBISPO

956 Walnut Street, 2nd Floor

San Luis Obispo, CA 93401

(805) 275-0943 | phone

SACRAMENTO

180 Promenade Circle, Suite 300

Sacramento, CA 95834

(916) 209-8525 | phone

MODESTO

1300 10th St., Suite F.

Modesto, CA 95345

(209) 286-0069 | phone

SANTA BARBARA

414 Olive Street

Santa Barbara, CA 93101

(805) 275-0943 | phone

SAN MATEO

1650 Borel Place, Suite 216

San Mateo, CA, CA 94402

(650) 398-1644. | phone

STOCKTON

110 N. San Joaquin St., 2nd Floor

Stockton, CA 95202

(209) 286-0069 | phone

PORTLAND

425 NW 10th Ave., Suite 200

Portland, OR 97209

(503) 343-9983 | phone

TACOMA

1201 Pacific Avenue, Suite 600

Tacoma, WA 98402

(253) 345-1545 | phone

KENNEWICK

1030 N Center Pkwy Suite N196

Kennewick, WA 99336

(509) 255-3442 | phone

2023 Sierra IP Law, PC - Patents, Trademarks & Copyrights - All Rights Reserved - Sitemap Privacy Lawyer Fresno, CA - Trademark Lawyer Modesto CA - Patent Lawyer Bakersfield, CA - Trademark Lawyer Bakersfield, CA - Patent Lawyer San Luis Obispo, CA - Trademark Lawyer San Luis Obispo, CA - Trademark Infringement Lawyer Tacoma WA - Internet Lawyer Bakersfield, CA - Trademark Lawyer Sacramento, CA - Patent Lawyer Sacramento, CA - Trademark Infringement Lawyer Sacrament CA - Patent Lawyer Tacoma WA - Intellectual Property Lawyer Tacoma WA - Trademark lawyer Tacoma WA - Portland Patent Attorney - Santa Barbara Patent Attorney - Santa Barbara Trademark Attorney